A realistic look at home ownership, from the eyes of an inspector…

The tl;dr version: Nope. You’re buying a house. Not taking the time to read and research everything you possibly can has the potential to cost you thousands! Grab a seat in your favorite reading spot and read on. We are aware that this is probably being read from the bathroom and we’re OK with that!

Purchasing a home in this economy is tricky, to say the least. How much does it really cost to buy a home? What fees can I skip when buying a house? Why is a home inspector even talking about this? As a home inspector, it is our job to provide an unbiased report on the condition of your home. That’s it. We are in no way involved with the rest of the transaction and have no financial interest in the house. That’s why we’re talking about this – so you’re not hearing it from those that do have a financial interest in your purchase of the home.

By the time people reach the home inspection phase of homeownership, many are exhausted and ready to just get moved in. So, we thought it would be interesting (and maybe beneficial) to take a look at some of the fees and who gets paid out of those fees.

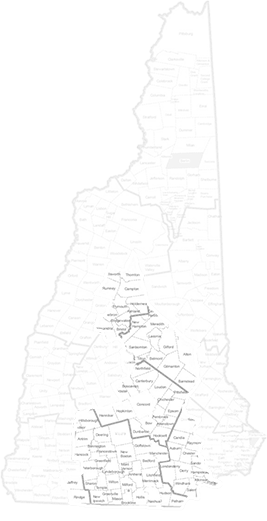

As of this writing, the median price of a home in NH is a little over $400,000. So to be safe, let’s consider a $450,000 house in this example. If you are prepared to put down $25k (that’s only about 5%), that leaves the amount to borrow $425k. For the purposes of this article, we will assume there is an escrow account that property taxes and homeowner’s insurance will automatically get paid from.

Using a readily available mortgage calculator, for a 30-year mortgage, we’ll plug in:

Interest rate of 3.346%

Property Taxes $7000/year

Homeowner’s Insurance $1600/year

Since your down payment was less than 20% of the home’s value, you’ll likely be required to pay Private Mortgage Insurance (PMI). This insurance is usually calculated anywhere from 0.25%-2% of the loan. That may work out to $150(ish)/month. This can disappear (when YOU ask your lender) once you’ve paid down the mortgage to 80% of your home’s value. In this example, once your remaining mortgage balance is less than $360k, you can remove the PMI. I have to remember to do that!? Yup, sorry. However, when the balance drops to 78% of your home’s value, the lender is required to eliminate the PMI. Considering the majority of your payment is put toward interest, this could still take a couple years. So it is worthwhile to make the calculation and call your lender as soon as you have paid down the mortgage to 80%!

That puts your mortgage payment at roughly $2,700/month. $1,835 of that goes to the loan (principal and interest), and $865 goes to taxes and insurances.

Most prospective buyers stop doing the calculations and determine what they can afford at this point. But wait – the fun doesn’t stop here! For poops & grins, let’s look at the numbers a different way. You’re paying $2,700 for 30 years (720 payments). That’s approaching $2M you’ve paid by the time your house is paid off!

Closing costs? What are those!? We’re just starting to scrape the surface here. On average, you’ll be faced with another 4% in costs to cover expenses such as, loan application/origination fees, closing & escrow fees, courier fees (yes, those do exist!), credit report fees, escrow deposits for taxes and insurance, recording fees, real estate transfer taxes (the state, town and/or county all need their cut, too!), notary fees, survey fees, wire transfer fees and underwriting fees.

So, 4% of that $425k calculates out to an additional $17,000 on top of what you are already paying. No problem though, that can be rolled right into your mortgage and spread out over the next 30 years. That’s an extra $75/month. No big deal, right? Let’s drill down into that one just a little more…

$75/month x 720 payments=$54,000 over the life of the loan.

If you haven’t passed out from sticker-shock yet, that means you are must be in good financial health to purchase a home. However, there are a couple other small items to talk about. First, the appraisal. If you’re financing your home, your lender will likely require an appraisal. The appraisal costs upwards of $500 (and could be much more now that appraisers and lenders have respectively found a way to receive and pay bonuses, but that’s a different story for a different day!)

Good grief! Another $500!? I can’t afford that right now! No worries – you can roll that into your loan as well. In all honesty, it works out to a measly $2/month.

Whew! Hold on now… what else haven’t you told us yet?

$2/month over 720 payments (including interest) works out to be = $1440 over the life of the loan.

Well, it is what it is, I guess. I can’t wait to share it on Instagram! Let’s buy the house!

Hold up – did you and your agent discuss the home inspection? Were you advised to skip the home inspection to make your offer more attractive? Many prospective buyers are exhausted from the process and the idea of a quick close (roughly 30 days) sounds fantastic. Better agents will recommend you get an inspection – not only does it offer an additional layer of protection for YOU, but also for the seller (and themselves)!

But we don’t have time to wait for an inspection plus we don’t have any extra money right now. Let’s just move in and deal with it later.

Are you strapped for cash and looking to save a few bucks? The home inspection is NOT the place to cut corners! Yes, a quick close is super convenient (especially for those parties that are waiting to get paid when your purchase finally goes through!). However, it can be a HUGE financial risk (you’ve already committed $2M at this point) if there are problems festering in your home that you are not aware of. How is the roof condition? Will that heating system operate reliably for another 10 years? Are you financially prepared to replace any major systems when they wear out?

The agent told me they’ll provide a home warranty if I skip the inspection!

A home warranty is NOT a substitute for an inspection. If you are seriously considering this option, do your homework and read the fine print. Many warranties require a home inspection, and many warranties will not cover items older than a specified age. So, if your furnace is 30 years old and dies three days after you take ownership, that warranty will likely NOT cover the cost of a new system! Remember, the goal of your home inspector is to educate you about your home’s systems and help you understand what the house will require of you in the coming months (and years) as far as maintenance and repairs.

Oh, maybe that is a good idea. My agent said that should only cost a few hundred bucks and has someone that can do it tomorrow, so let’s just get it done and over with.

A 2,700 sq ft house on a private well and private septic is going to cost upwards of $1200 to have an experienced inspector perform the home inspection, water quality testing, radon air testing,

pest inspection and have a qualified pro evaluate the condition of the septic system. And most reputable inspectors are booked out at least a week in advance (sometimes less during the winter months).

Oh Emm Gee!!! We can’t afford that! Whatever – just roll it into the loan as well. No! You should NOT roll the inspection costs into your home loan!

Seriously!? Why?

Your home inspector is an independent third party that has absolutely no vested interest in whether or not you purchase the home. Or what the selling price of the home is. Think about that for a second – your home inspector is the ONLY person involved in the transaction that this applies to! A few inspectors will offer (for an additional fee) to get paid at closing so that you can roll the costs into your mortgage. This immediately puts your inspector in the ‘vested interest’ category since getting paid relies on you purchasing the home. Isn’t that incentive enough for the inspector to look the other way if there are problems?

That’s an interesting point. What do the people who have a vested interest in this transaction make? I don’t have to pay them at least…

Well, technically you do! It’s all rolled into that mortgage payment.

- Your agent. They sure have put up with a lot of late-night phone calls, emails and running all over the place with you! (You may find our “How to annoy a realtor” article entertaining). On average in NH, 4.6% of the home’s selling price goes to commissions. This has to get split between the Seller’s agent and broker, as well as your agent and his/her broker. On a $450k house, that’s $21,600 in commission is typically divided up 4 ways.

- Your mortgage lender. They have dealt with almost as many late-night phone calls and emails, too. Most lenders charge 1-2% of the loan value (that’s rolled into the closing costs we talked about earlier). That’s $4,250-8,500 they pocket.

- All the other people that charge the lender specific fees for credit reports, etc…

- The appraiser. $500 (or more). They do technically work for you (although the lines can be a bit blurred).

- The closing attorney/title company. They charge a small percentage and were likely included in the aforementioned closing costs/fees. The title fees depend on the price of your home, the complexity of establishing a clear chain of title, correcting any title defects that are uncovered. Fees typically range from $500 to a few thousand.

- Your Homeowner’s Insurance provider. They might make 5% off the new policy cost. In this example, we stated a $1600 policy – $80 commission.

That’s a lot of people that get paid when a home is sold – no wonder the prices are so high!

Please keep in mind these are just the costs to purchase your new home! It does not include anything with regard to any renovations you may want to do, home maintenance costs (read our home maintenance budgeting article, too) as well as furniture, décor and all of your personal items within. All of us here want your home-buying experience to be fun, exciting, and memorable. It’s a huge deal! We urge you NOT to rush through the process (don’t let anyone else rush you either!) and do your homework. You owe it to yourself. For many of you, your legs are likely getting numb and tingly at this point, so we’ll let you get back to house hunting… Enjoy the journey.

Please reach out to us with any questions you may have – remember, we’re in your corner!

Respectfully,

-Your Friendly Neighborhood Home Inspectors